| HOME | MEDIANS | COMMERCIAL PARKING LOTS | STREAMBANKS | INVASIVE PLANTS | TOWN PLANS | CURBSIDE COMPOSTING |

| REAL-PROPERTY TAXES & FEES | AFFORDABLE HOUSING | TOWN HALL CAMPUS | COMMUNITY GARDENS | ONE MILLION TREES |

| DEPARTMENT OF THE ENVIRONMENT | * * WHY NOT ? * * |

The Town of Cary administration has become a huge harvester of citizens' money.

| CARY'S SOLID-WASTE FEE HISTORY | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| FISCAL YEAR | FY 2025-26 | FY 2024-25 | FY 2023-24 | FY 2022-23 | FY 2021-22 | FY 2020-21 | FY 2019-20 | FY 2018-19 | FY 2017-18 |

| Sanitation Fee (Cost per month) |

$26.00 | $23.00 | $22.00 | $22.00 | $20.50 | $19.50 | $19.50 | $17.00 | $16.00 |

| Sanitation Fee (Cost per year) |

$312.00 | $276.00 | $264.00 | $264.00 | $246.00 | $234.00 | $234.00 | $204.00 | $192.00 |

Dialogue with Council members on the issues of real-property taxes has been difficult. One member wrote that the recently-defeated Bond proposal would have raised Cary real-property taxes by 9%. This is grossly in error. Had the Bond passed, and every project in it had been completed within budget [unlike Downtown Cary Park, which went over budget by 60%], then the cost would have raised taxes an amount equal to the 2024 increase of 41.8%. And this didn't include either operational and maintenance costs of the properties the Bond would have created, which just for Downtown Cary Park, amount to $6.4 million per year.

Several Council members repeat the meaningless and deceptive mantra that "Cary has the lowest tax rate in Wake County." This is, frankly, insulting, and shows an intent to deceive. The only relevant question is, how much will the tax rate that Council adopts at budget time increase real-property taxes next year over this year?

One Council member recently wrote that "Cary hasn't raised [real-property] taxes in over a decade." This is a mind-boggling assertion, especially after that Council member joined her colleagues in voting unanimously to raise Cary taxes 41.8% in 2024 and a further 4.75% in 2025.

I repeatedly informed several Council members of the huge increase in taxes that was proposed by the Town administration in 2024. I was told that my figures "weren't verified." I asked who would be able to verify the figures to their satisfaction, and never got an answer. I repeatedly asked Council members who didn't accept my figures to retain a qualified and independent economist or accountant to analyze my figures. Whether this was done, I was never told.

Here are the exact amounts Council's own property taxes increased after their unanimous vote to adopt the administration's proposed rate [Names are removed]. Perhaps seeing their tax bills served as "verification."

Some Council members [and also members of the Wake County Commission] either state outright, or imply, or do not correct government finance officers who state that real-property tax increases result from increases in homes' assessments. This assertion is flat-out wrong, and advancing the proposition is another example of attempting to deceive the citizenry.

The process of real-property taxation must be understood in a linear timeline. Here is what happens. (1) The county revalues real properties. (2) Only after that revaluation, the administration then proposes a tax rate. (3) Only after that proposed rate, the Council then has the widest possible choice between three divergent alternatives:

Setting the tax rate has no connection to the revaluation. Council is wholly unfettered in determining how much our taxes will go up or down.

The problem with our Council members' inability or disinclination to discuss tax rates rationally and transparently makes it impossible to get to the larger and critically more important question of why the Town is taking in ever larger amounts of money from citizens every year. Citizens deserve to know what the administration plans for the future, and also importantly, where Council members and candidates stand on those plans.

The North Carolina General Statute governing real-property taxation states:

"To calculate the revenue-neutral tax rate, the [jurisdiction's] budget officer shall:

Repeated 311 requests to the Town of Cary, and also to financial budget officers in Wake County, asking how "the average annual percentage increase in the tax base due to improvements since the last general reappraisal" were calculated resulted in no sensible answer. An Apex Council member informed us that town and county financial officials are simply informed by State officials what the individual Revenue Neutral Tax Rate for the respective jurisdiction should be, and then publish that rate.

For Cary in 2024, had it adopted its published Revenue Neutral Tax Rate, our taxes would have increased 6.9%, bringing in additional tax revenue of over $7.3 million.

For Wake County in 2024, had it adopted its published Revenue Neutral Tax Rate, our taxes would have increased 6.5%, bringing in additional tax revenue of over $75 million.

Wake County commissioners recently voted to decrease the time between revaluations from every four years to every two years (after a three-year phasing-in in 2027). This means that, if the County and the Town adopt their respective statutorially-required Revenue Neutral Tax Rates after revaluations, each will still raise its taxes by between 6.5% and 7% after each revaluation.

The practical result of this decrease will be that incumbent council members and commissioners will be insulated from political responsibility for raising taxes because they will be able to say, ostensibly truthfully, that they didn't raise taxes because they voted to adopt the Revenue Neutral Tax Rate.

For the reason shown above, that is false.

The stated reason for the shorter interval between revaluations was given [here, by Marcus Kinrade, Wake County tax administrator] as "reducing sticker shock" citizens feel when looking at their staggeringly increased home assessments. This is pure tommyrot. What causes shock – as well as anger and feelings of betrayal – is seeing a huge increase in the real-property tax bill.

If the Wake County Commission and the Cary Town Council wish to avoid causing citizens to feel sticker shock, they should simply NOT RAISE TAXES! See "The process of real-property taxation . . . " above for the full explanation of this.

Since commercial property increased in value less than residential property, the increase in residential taxes is a greater percentage than commercial. For the Town of Cary, where the Council voted unanimously to raise taxes by 41.8% overall in 2024, the increases in Council members' homes increased by an aggregate of 51.1%. See the chart above.

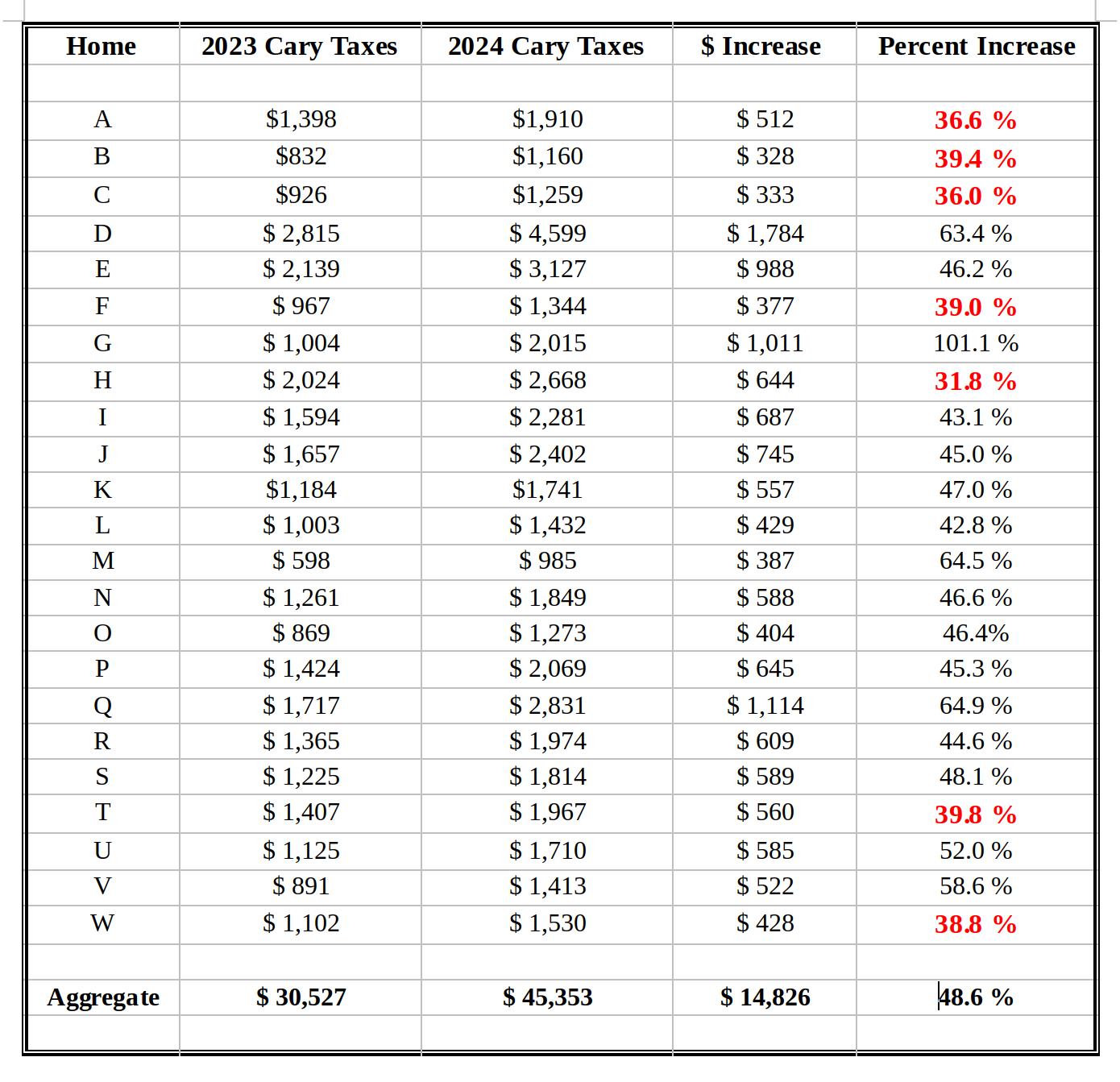

While the Cary Council was deciding what tax rate to adopt, some folks asked me to calculate what their Cary real-property taxes would be if the Council adopted the 31.5-cent rate recommended by the administration. The Council did unanimously vote to adopt the recommended rate. The chart below shows exactly what the tax increases would be for individual homeowners, with the aggregate increase being 48.6%.

The present Council voted to unanimously in June, 2025 to raise the property-tax rate to 34 cents per hundred, which was a 4.6% increase. The Council also unanimously voted to increase the solid-waste fee by $3 per month, to $26 per month, or $312 per year (the largest hike in Cary history), which is an increase of 13%.

The Council as constituted after the 2025 election will meet in June, 2026, with the tax rate and solid-waste fee on the agenda.